What is the relationship between gold and money supply? Many believe that changes in the gold price are simply the product of money supply changes. More money relative to a fixed supply of gold leads to a higher gold price and vice-versa.

In reality, the relationship is not quite so simple. Gold is not driven solely by money supply growth, but by money supply growth not backed with economic growth.

Gold and Money Supply: The Facts

I was often troubled by the performance of Gold over the decades: why was it that the Gold price went up substantially in some decades such as the 1930’s or 1970’s and yet went nowhere in other decades like the 1980’s and the 1990’s. I examined the money supply growth over these decades and found little difference between the decades in question.

Gold experts continued to claim that gold and money supply were directly linked: print more dollars relative to a fixed supply of gold and the dollar-gold price must go up. That all sounded good in theory; but in practice the claim didn’t stack up.

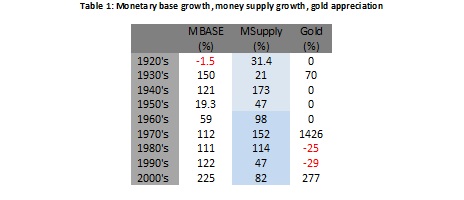

- Monetary Base, Money Supply (M2), and Gold

We see that gold did well in the 1930’s, 1970’s and the 2000’s and yet monetary growth was not larger in these decades than in decades when it did poorly, for example in the 1980’s and 1990’s. I realised that money supply growth in isolation could not explain changes in the price of gold, although it is an important factor. So what does drive the price of gold?

What Drives the Gold Price

I realised that the differentiating factor between the 1970’s and the 1980’s was the state of the economy, rather than monetary growth. The 1970’s was decade of poor economic performance; whereas the 1980’s was a recovery decade.

Inflation was such a problem by the end of the 1970’s that policy makers and central banks decided to take the pain in the early 1980’s and raise interest rates. This action was painful in the short-run, but it did clear out the system and created a healthy foundation for future growth in the 1980’s and 1990’s.

It was not only monetary policy that gave the 1980’s an edge over the 1970’s, but also fiscal policy. Policy makers realised the limits of government power by the end of the 1970’s. Tax rates were reduced, union power was curbed and state-run enterprises were privatised.

So when economic growth picked up in the 1980’s, we experienced an increase in purchasing power of the dollar: that is we had the same amount or slightly more dollars relative to an increasing amount of goods (or gold). The increase in purchasing power of the dollar through productivity growth meant it was necessary for the price of goods (or gold) to go down, unless the supply of dollars was increased in unison, which they almost were in the 1980’s and 1990’s.

Equally, when the economy was contracting in the 1970’s, it was necessary to contract the money supply by an equal amount relative to the supply of goods in order to stabilise goods (gold) prices. By propping up the money supply in the face of a declining economy, the authorities brought about a huge increase in the price of gold in the 1970’s.

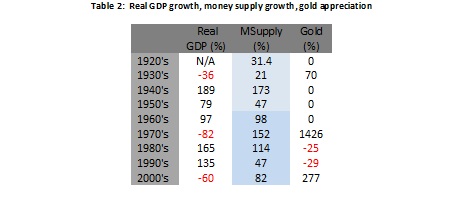

Once I had established this principle, it was easy to explain long-run trends in the price of gold. In the table below I have deflated nominal GDP by the price of gold and plot against money supply growth and gold appreciation:

- Real GDP, Money Supply (M2), and Gold

The price of gold is the link between real growth and monetary growth: real growth in-line with monetary growth leads to a flat gold price; real growth below monetary growth leads to a rising gold price; real growth above monetary growth leads to a falling gold price.

The Current Situation

The money supply would have dropped substantially in 2008 without the crutch of quantitative easing. QE has driven up the gold price by propping up the money supply in the face of a declining real economy. As there was more money chasing fewer goods, it was inevitable that goods prices (commodities) would increase substantially. The CPI has increased by a far smaller amount however, due to the changing consumption patterns caused by economic hardship.

The Fed had previously encouraged monetary growth through short-term rate changes, but as it has an aversion to taking nominal rates negative; balance sheet expansion is their new tool. Until the Fed changes policy, as it surely will once the public turns against inflation, the outlook for gold remains highly positive.